This section uses a loan application,

AD-Capital, to show the workflow and several milestones or steps involved in processing a loan. Similar to a typical loan application process, the workflow in this Business Journey starts with application submission, followed by document verification, credit check, underwriting, and finally, loan approval.

About the Milestones Data

Data for each milestone comes from different applications and different AppDynamics event types, such as business transactions, logs, or end-user events.

In this workflow, the data associated with application submission comes from business transaction events, whereas document verification status comes from logs. Credit check and underwriting are performed by third-party service providers and the status is updated in logs. The loan approval status is then updated in the transaction events.

Extract Fields: Primary Key and Additional Fields

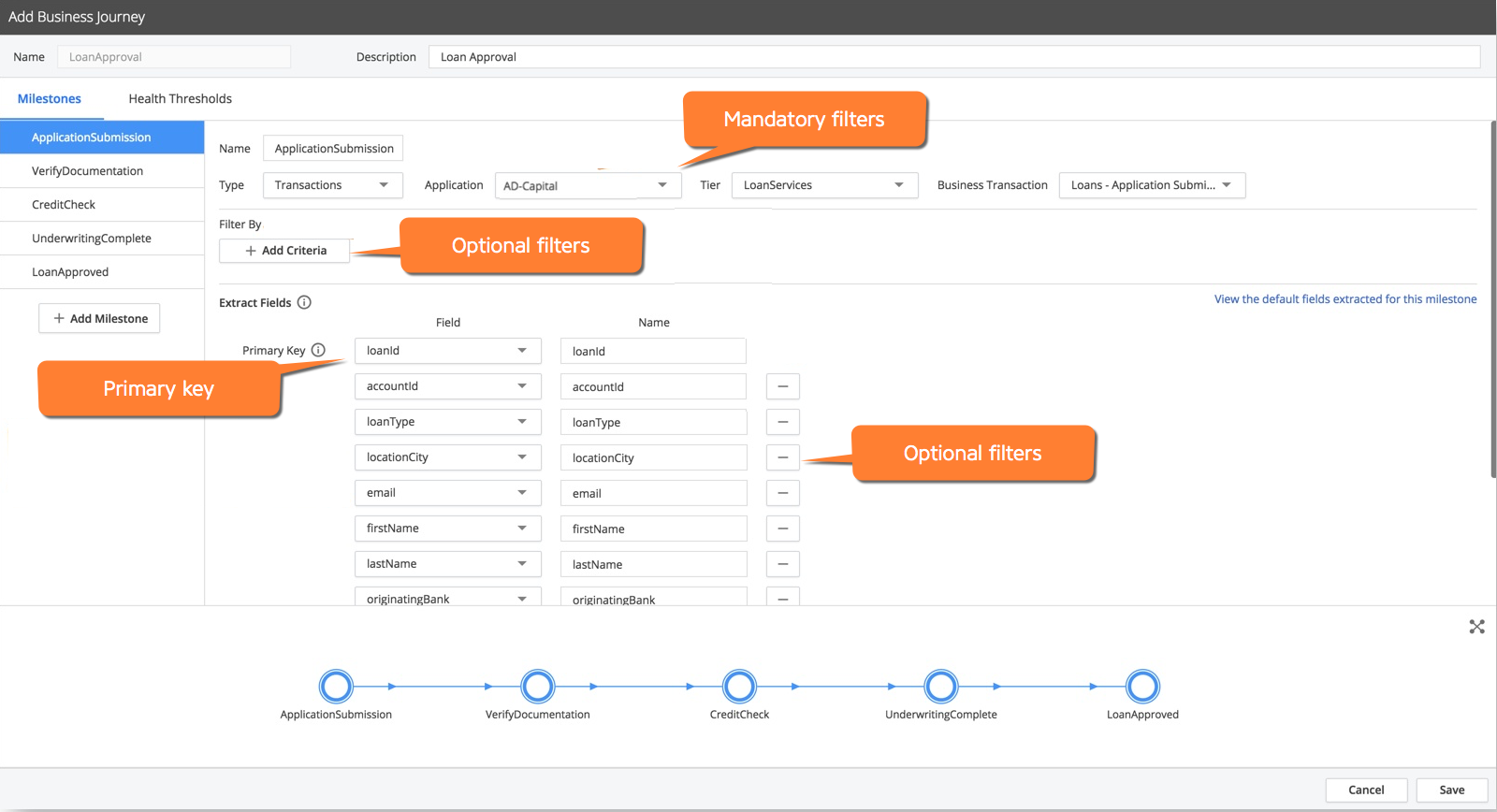

Choose a distinct primary key that uniquely identifies and ties together these independent milestones to represent loan application. In this example, loanId is used as the primary key.You enter loanid in the Primary Key field in each milestone.

In addition to the default information collected by the Business Journey, such as event timestamp, you can extract additional business information, such as customer details, loan amount, loan type, bank name, and so on using the optional fields. These additional fields provide further context for your Business Journey definition. You can also use these fields to run ADQL queries later on.

Define Milestones

In this example, the application submission milestone is defined. The mandatory filters to limit the events for this milestones are Type, Application, Tier, and Business Transaction. You can see that loanId is used as the primary key. Additionally, fields such as accountid, loanType, email, and so on are extracted in this milestone.

Similarly, the milestone for underwriting is defined as shown below:

Underwriting is performed by third-party service providers and the status is updated in logs. Therefore, Logs is used as the Type of event source.

Similarly, define all other milestones. Validate and save the Business Journey. It takes a few minutes to display the generated records from the associated events.

Troubleshoot the Example Business Journey

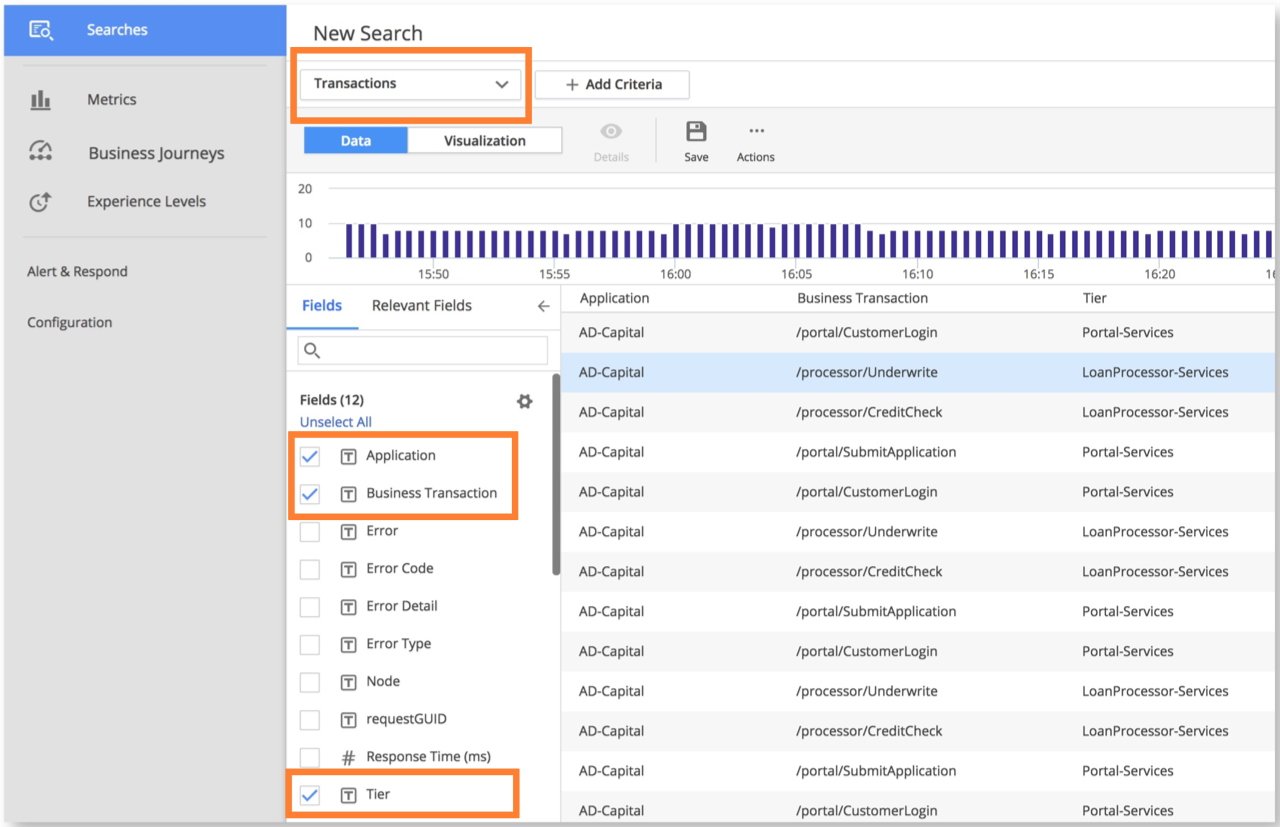

If you think the combination of fields and filters that are selected for each milestone is incorrect, you can validate it with an ADQL query search or by using the Analytics Searches widget as shown below:

The Search page shows all the valid values for your selection. On the screen, you see the valid Tiers and associated Business Transactions for AD-Capital.

Alternatively, you can visit the Tiers & Nodes page of the AD-Capital application in the Controller.

Run Analytics on the Example Business Journey

Use one of the search methods from the Searches screen to view data, run analytics, or visualize the performance of the Business Journey you have just created. In this example, the progress of the credit check process is displayed for different types of loans defined in AD-Capital.

View the Example Business Journey

You can view dashboards and widgets of the loan approval Business Journey on the Dashboards & Reports UI. The visualization makes it easy to understand the performance of loan application workflow.

The funnel widget is given on the left side of the image. This widget represents the overall conversion rate, the health of participating events, and the number of abandoners at each critical step in the loan application process. At the center of the dashboard is a widget that illustrates slow business transactions at each step in the Business Journey. The widget on the lower right side of the image compares credit check providers on the basis of credit approvals. The widget on the upper right side displays the number of loans approved in different cities.